But now, Wells Fargo employees are also coming forward with their own class action lawsuit, seeking $7.2 billion or more for workers nationwide who were fired or demoted after they refused to open those fake accounts.

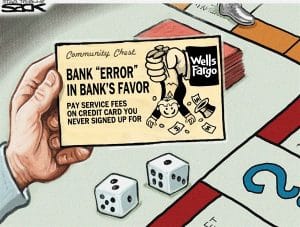

It’s the latest legal challenge for Wells Fargo, which earlier in September was fined $185 million for inflating sales metrics through the creation of up to two million fake bank and credit card accounts. Wells Fargo was also subjected to a hearing in the House, an investigation from the Department of Justice and a merciless grilling by Senator Elizabeth Warren of the Senate banking committee.

Wells Fargo admitted to firing a stunning 5,300 employees since 2011 for the improper sales tactics. But dozens of those terminated employees reached out to employment law attorneys to report that they were fired after refusing to open unauthorized accounts under pressure from their supervisors — or even after they directly reported those abuses on an ethics hotline.

Alexander Polonsky and Brian Zaghi, both fired from Wells Fargo in Los Angeles, say they were terminated after failing to meet completely unrealistic sales goals of 10 new accounts opened per day.

Late in September, the two filed the lawsuit in California Superior Court alleging “wrongful termination/retaliation,” violations of California labor code, failure to pay wage and other charges. The suit represents California employees who were employed by Wells Fargo during the past 10 years or who continue to work there and were fired, demoted or forced to resign after failing to meet those sales quotas.

Employees who resisted participating in the scam were “systematically and routinely terminated,” while those who did open unauthorized accounts were often promoted, the lawsuit alleges.

Nearly a half-dozen Wells Fargo employees even reached out to CNNMoney to claim they were fired after calling attention to unethical sales tactics by reporting them on the company’s ethics hotline.

The federal class action alleges Wells Fargo violated several laws, including Dodd-Frank and the section of Sarbanes-Oxley that prohibits retaliation against whistleblowers. Moreover, the lawsuit alleges that Wells Fargo compelled employees work beyond 8 hours a day without paying overtime, violating the Fair Labor Standards Act.

Both suits claim that Wells Fargo employees suffered damages including loss of income, back pay as well as “emotional distress” and “mental anguish.”